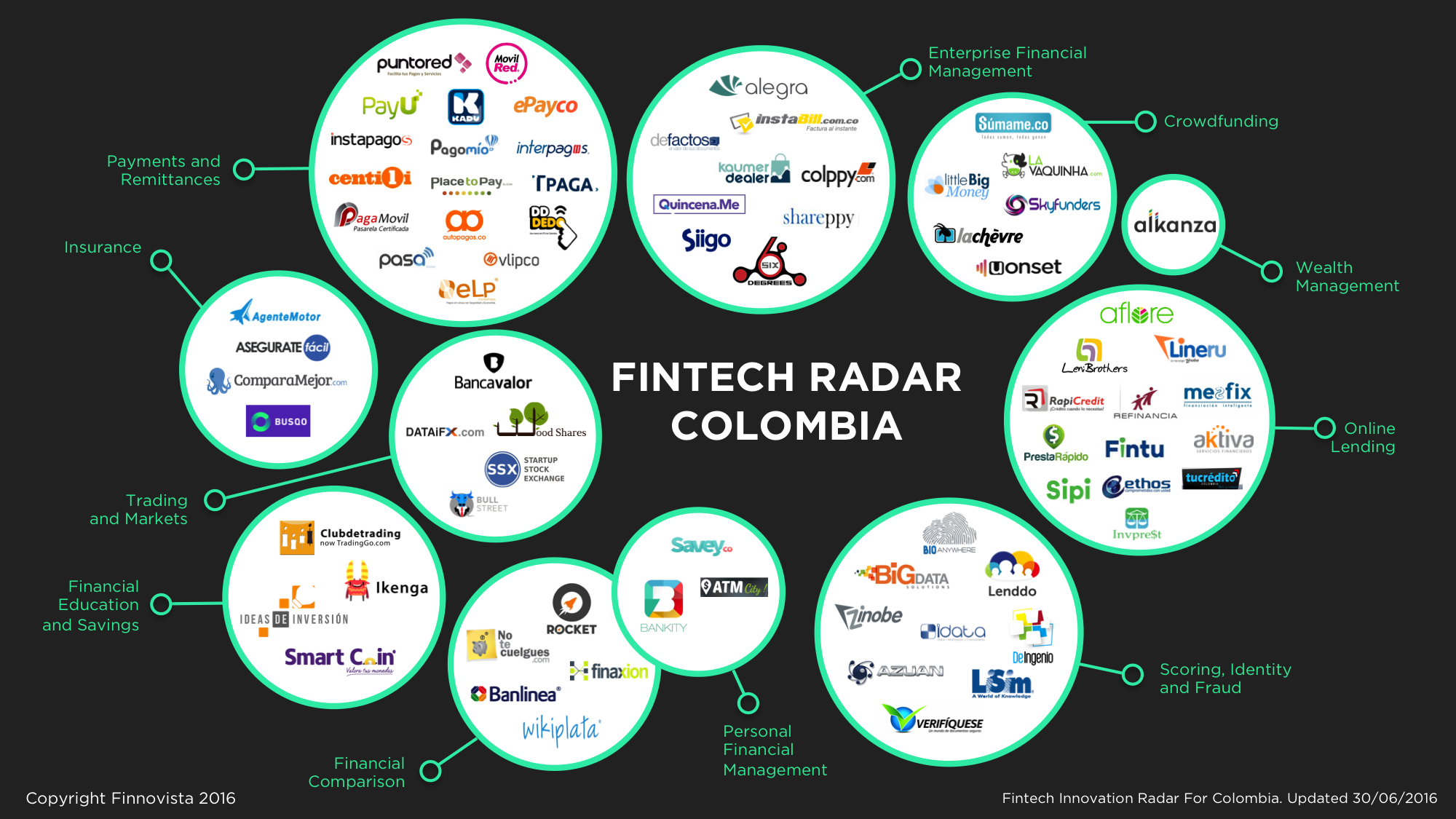

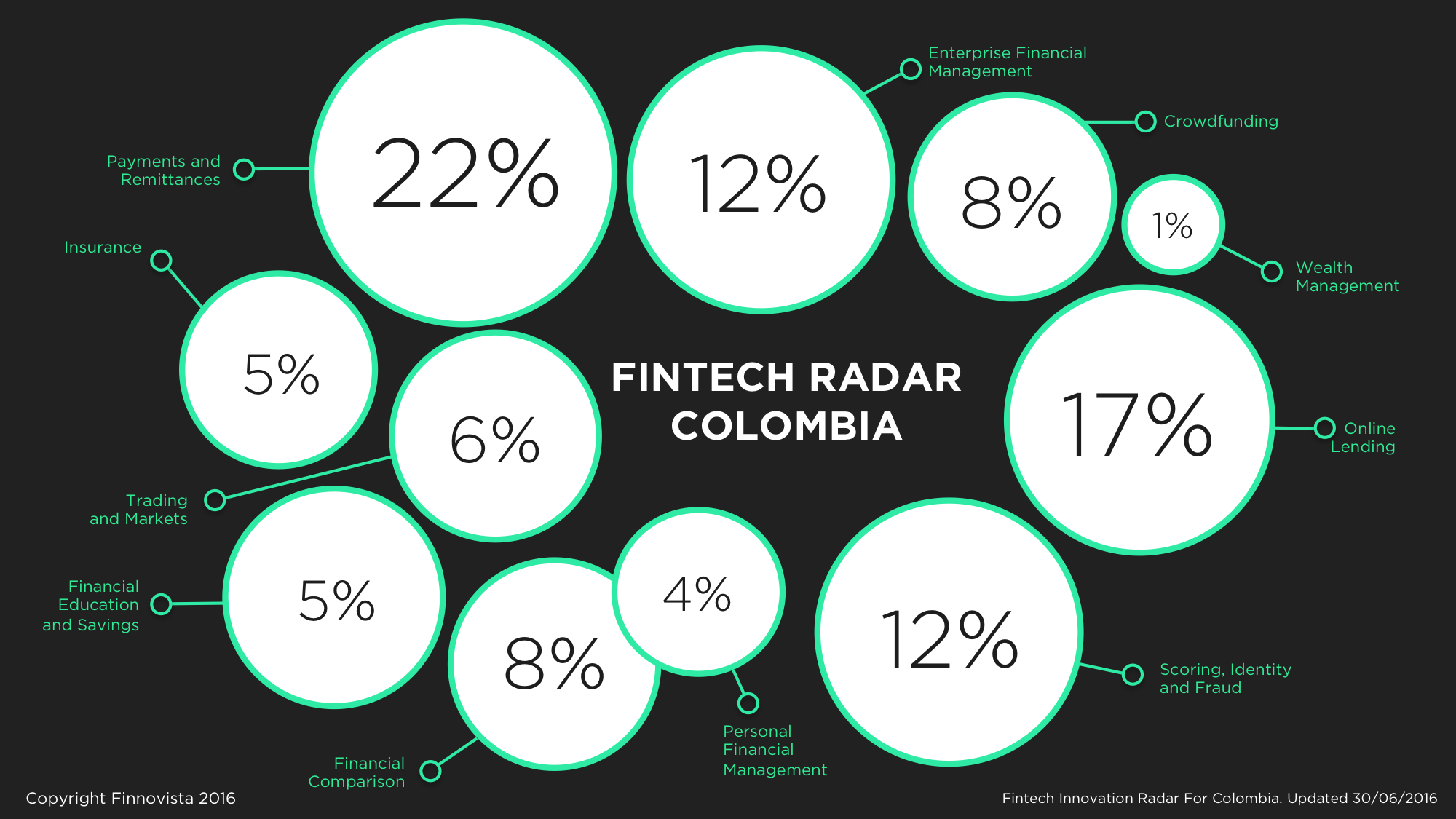

It doesn’t come as a surprise that the Lending sector, and to be more specific the micro-loans one, is gaining every day a higher number of specialized startups, because Colombia is one of the countries (as the rest of Latin America) where a huge part of the populations remains unbanked. This way people get access to loans that so far were not covered by traditional microfinance, who usually charged a commission of a three percentage points not affordable for this target sector. Every day there are more startups who offer this type of solutions to solve problems of financial inclusion. This is the case of Aflore, TucreditoColombia or Refinancia who offer, through their solutions, access to financial services in a more inclusive way through a more reasonable cost for those who don’t have the necessary means.

In a medium term we are hoping to see how the Personal Finance Management startups flourish, or the personal finance ones like Bankity, , or the Crowdfunding startups like Startup Stock Exchange, where regulation in many countries has changed to include and promote this type of services as possibilities for financing individuals and enterprises and where is expected to change in the region as well .

From Finnovista, we want to thank all the Mentors that have made this project of Fintech Radar Colombia possible and that have contributed with all their knowledge to the making of more complete mapping. They are: Ana Barrera, Alan Colmenares, Andrés Ramírez Sierra, Camilo Velasquez, Carlos Castañeda, Cesar Andrés Bello Pinto and Fernando Sucre. Thank you very much for your support and help.

Do you know any colombian Fintech startup that has not been included to our Fintech Radar?