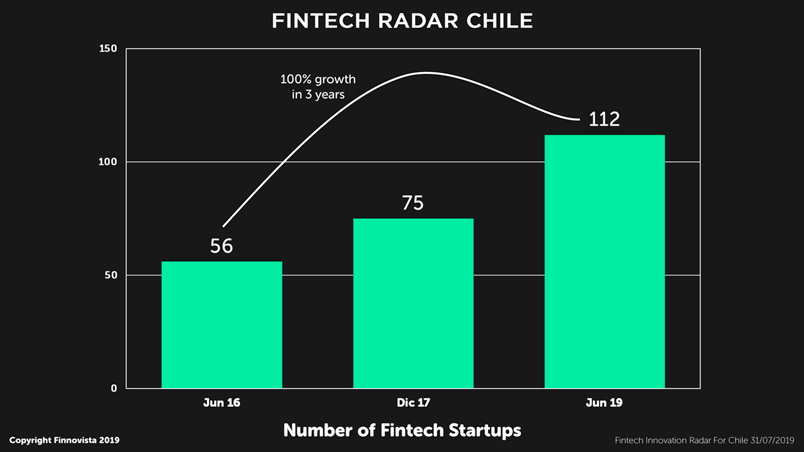

Beyond the Radar, this report gathers the results from a survey responded by 49 out of the 112 Fintech startups identified in the country so far, representing 44% of all of them.

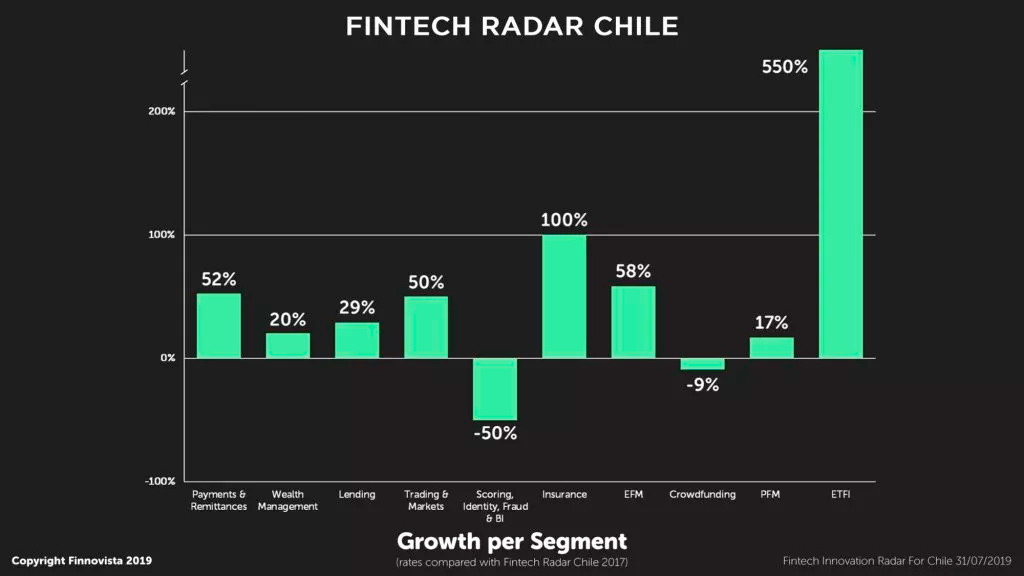

Our research also confirms that the mortality rate for Fintech startups in the Chilean ecosystem is close to 12% for the same period. Nevertheless, this new edition of the Radar includes 46 additional startups when compared to our past publication.

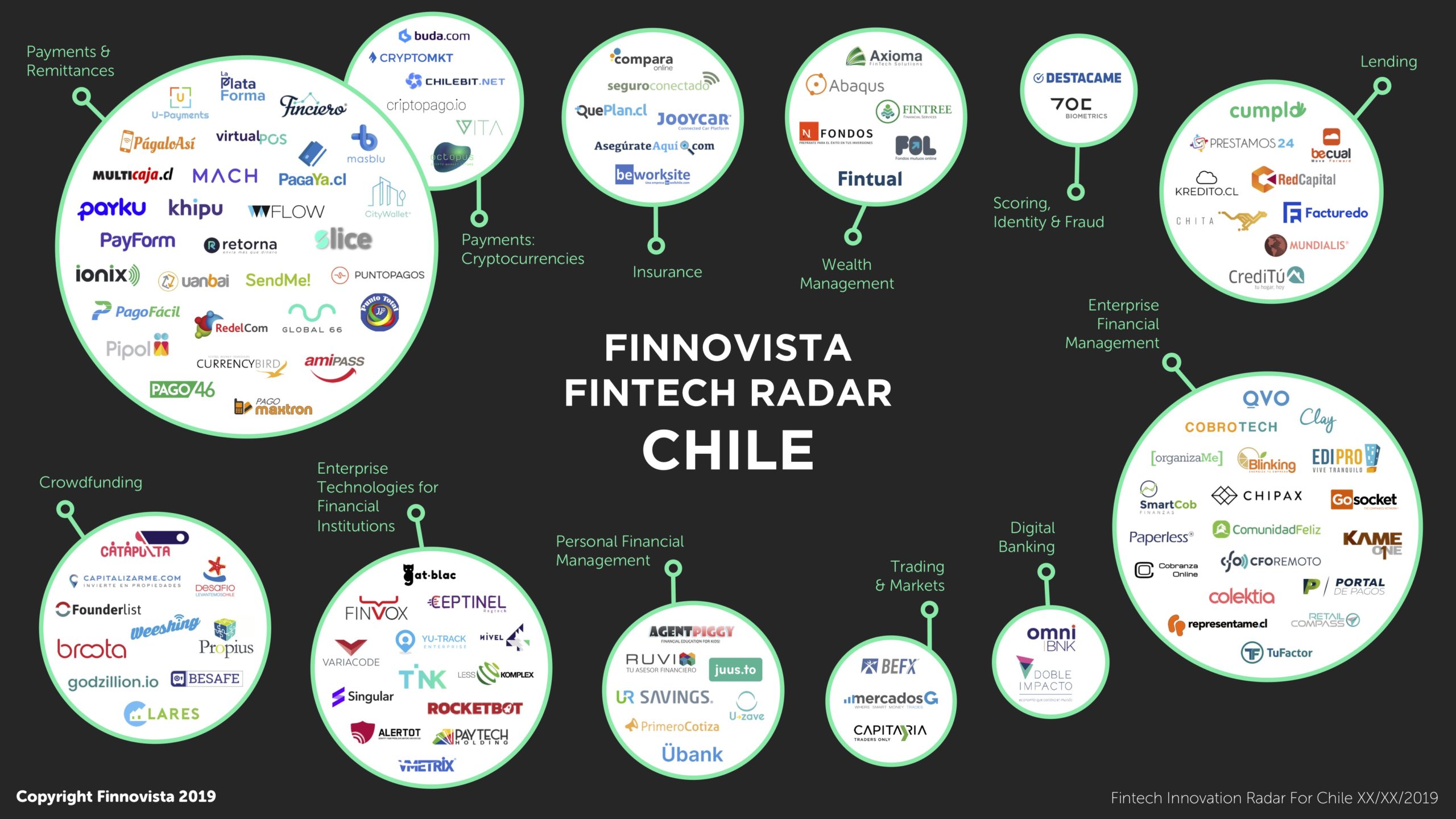

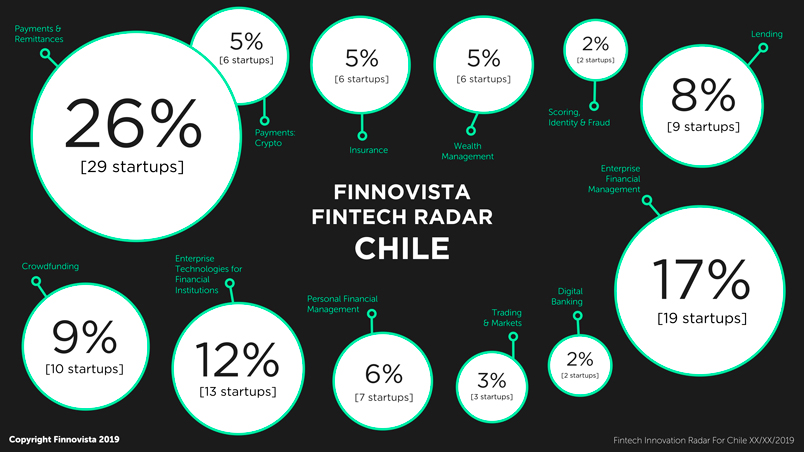

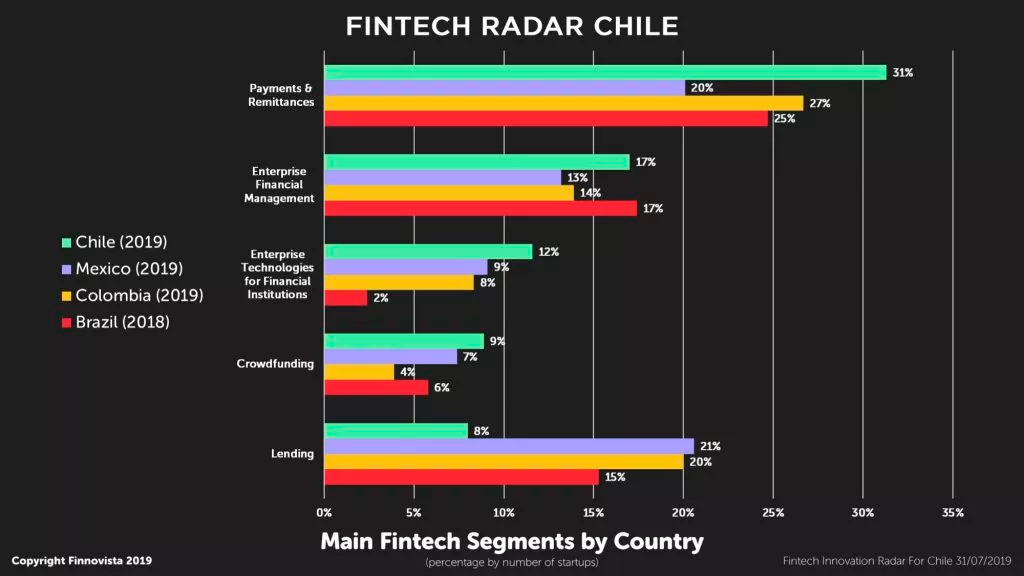

Payments & Remittances remains as the predominant segment by representing 31.3% of the identified startups (35 startups), followed by the Enterprise Financial Management segment which amounts to 17% (19 startups) staying in second place as in the previous version. However a greater activity was observed in the segment of Enterprise Technologies for Financial Institutions which displaced the Crowdfunding segment as the third most active segment in the Chilean ecosystem adding up to 11.6% (13 startups).

According to their size, the distribution of Fintech segments in Chile is:

- Payments & Remittances, 35 startups (31.3%)

- Enterprise Financial Management, 19 startups (17%)

- Enterprise Technologies for Financial Institutions, 13 startups (11.6%)

- Crowdfunding, 10 startups (8.9%)

- Lending, 9 startups (8%)

- Personal Financial Management, 7 startups (6.3%)

- Insurance, 6 startups (5.4%)

- Wealth Management, 6 startups (5.4%)

- Trading & Capital Markets, 3 startups (2.7%)

- Scoring, Identity & Fraud, 2 startups (1.8%)

- Digital Banks, 2 startups (1.8%)

Do you know any other Fintech startup that was not included in our Fintech Radar?