It is no longer a secret that the Fintech revolution has reached Latin America, and a growing number of countries in the region have decided to catch this wave of financial innovation and invest in new technologies to improve the traditional financial system. A number of reports have highlighted the consolidation of the sector in Latin America in recent years, such as the 2018 LAVCA Industry Data & Analysis, recently published by the Latin American Private Equity & Venture Capital Association, where they highlighted that the volume of private equity and venture capital investments in startups in Latin America increased up to 8.4 billion dollars across 424 transactions and that, out of the total amount of global investments made in Latin America between 2013 and 2017, 24% of them were assigned to the Fintech sector.

On the other hand, Finnovista has conducted over 15 studies on Fintech innovation throughout its Fintech Radars in the main Latin American Fintech markets, in order to obtain a comprehensive source of information about Fintech entrepreneurship, assess the evolution of the sector and give visibility and recognition to this innovative wave that will lead to a more inclusive financial system. To this day, Finnovista has published Fintech Radars of Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru and Spain, and in those markets in which an update has been made, we have always seen a sector growth of over 30%, a further proof of the surge the sector is undergoing. On this occasion, Finnovista has conducted an update of the last version of the Fintech Radar Argentina, published in September 2016.

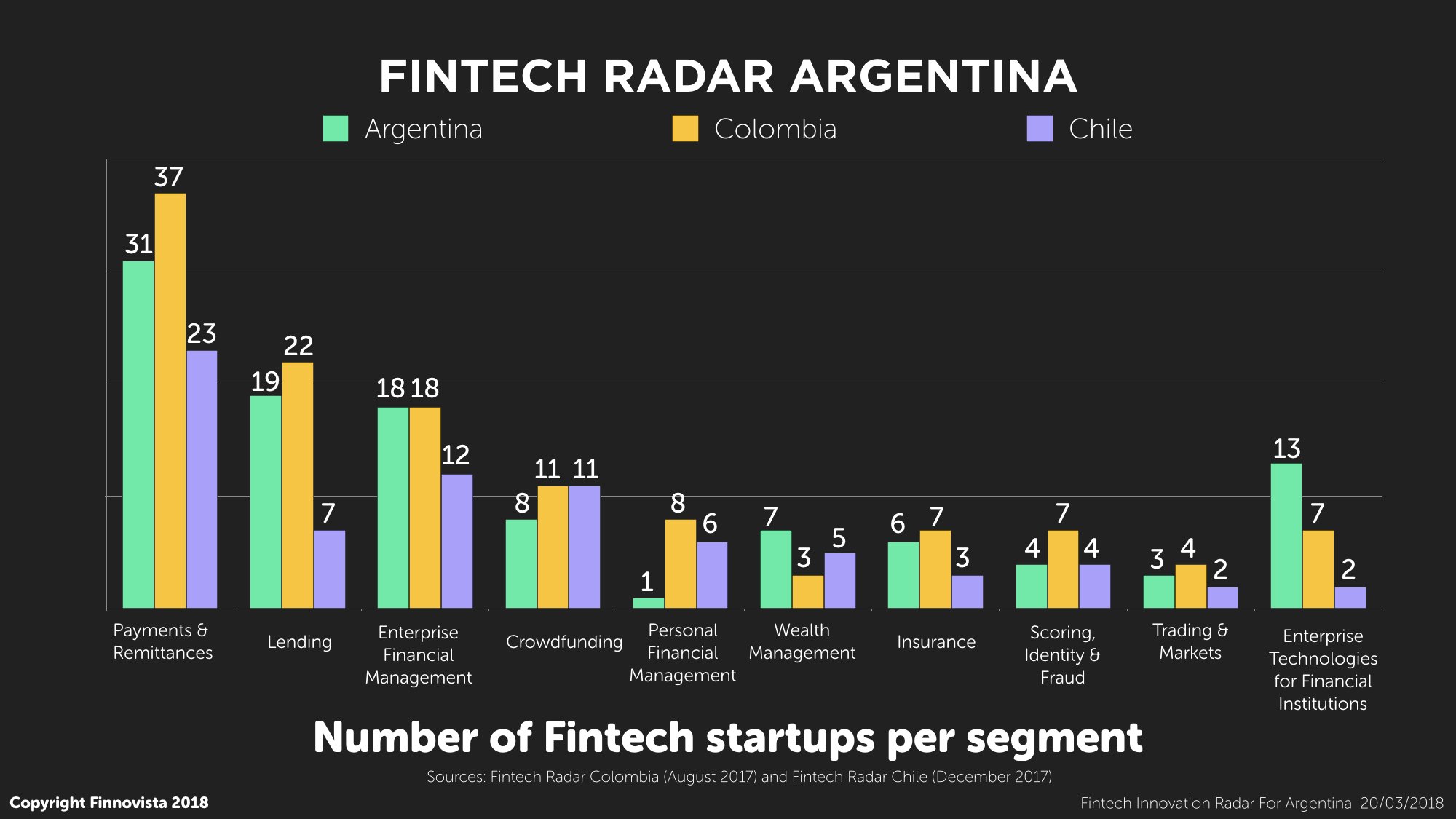

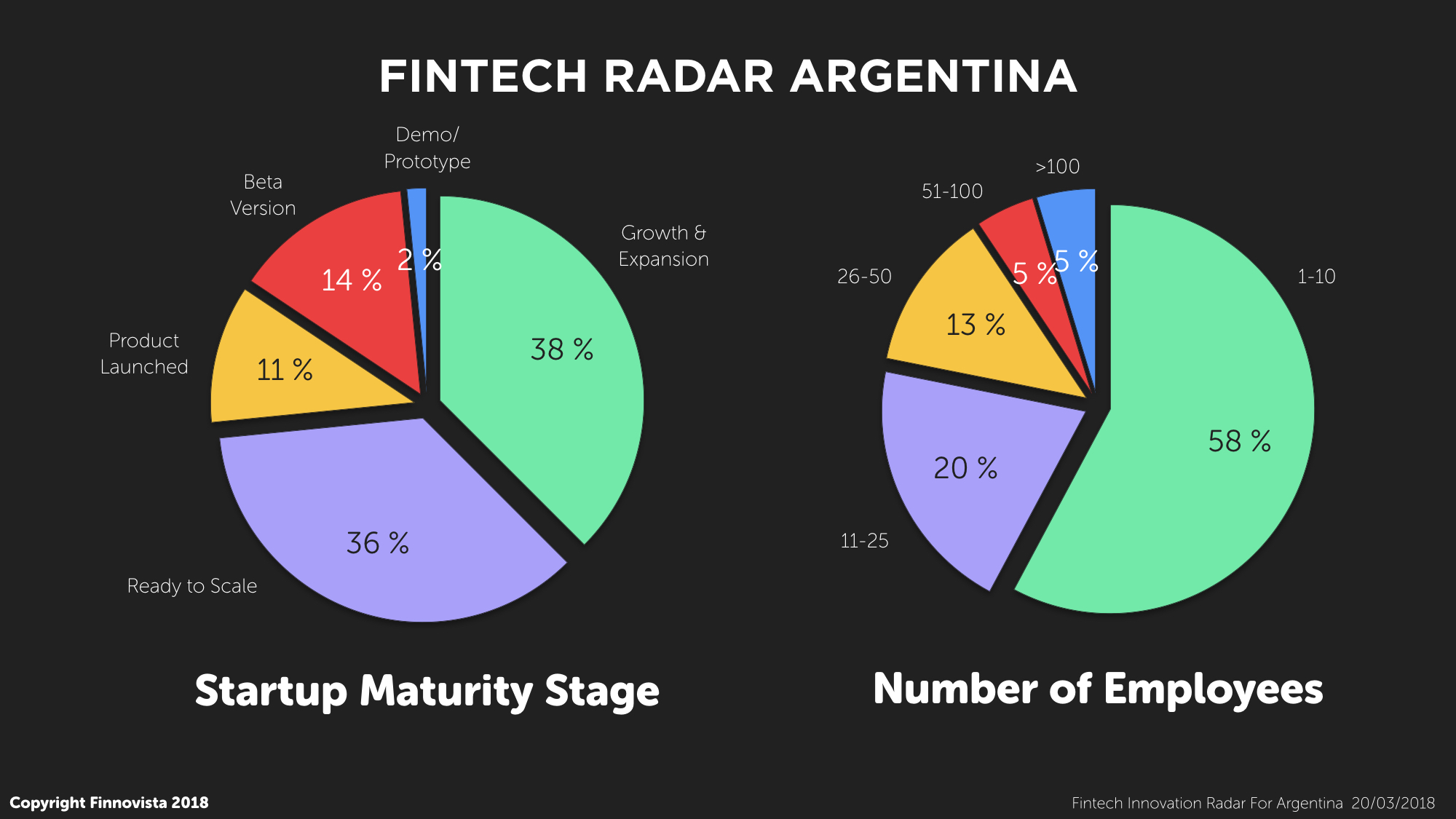

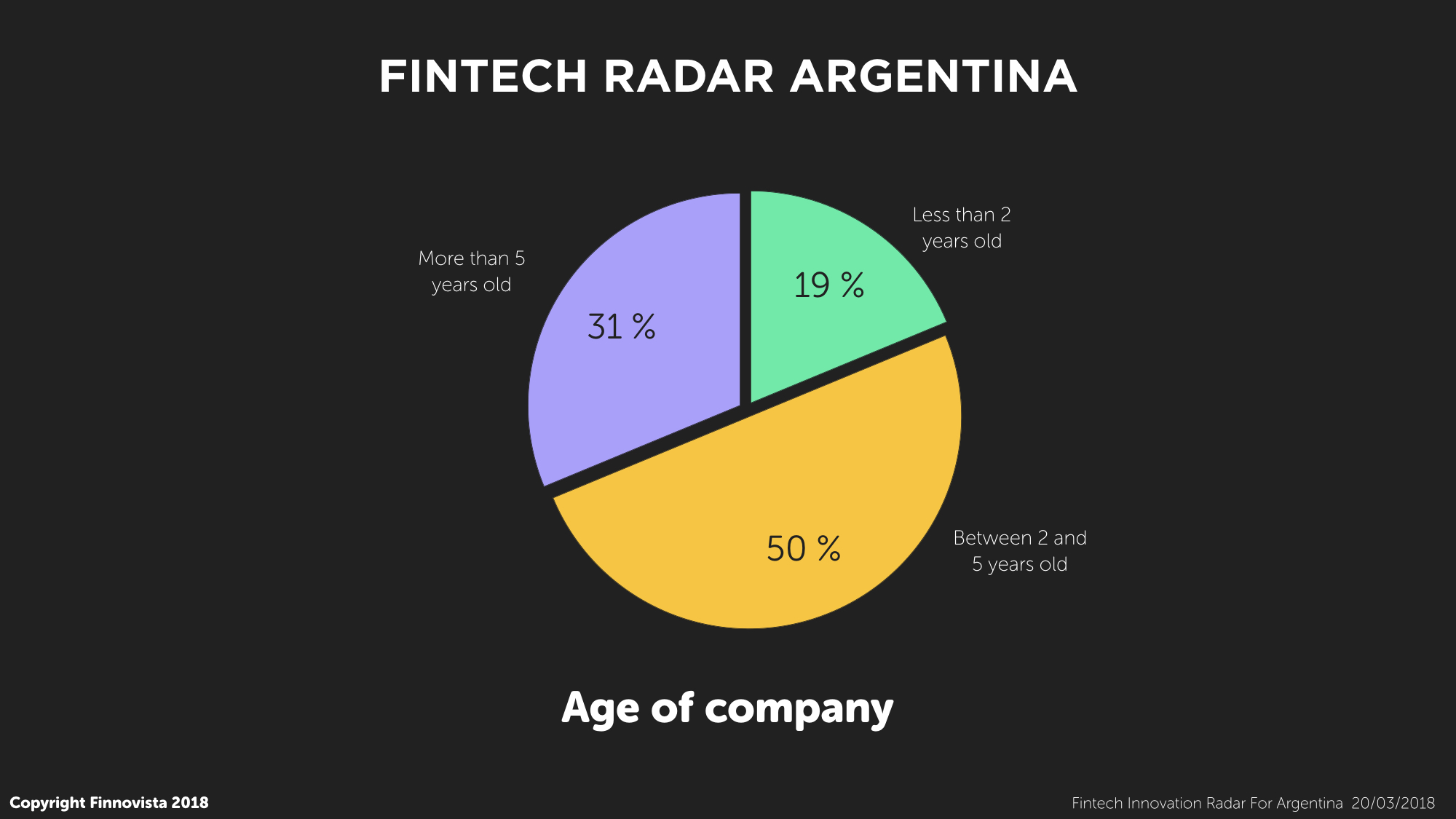

In this new edition of the Fintech Radar Argentina (March 20th, 2018), 110 Fintech startups have been identified throughout 10 Fintech segments, which represents an increase in the number of Fintech startups of 83% since the last edition published in September 2016, where 60 Fintech startups were identified. If we take into account that 8 of those 60 startups are no longer active, we observe that in the last year and a half 58 new startups have been launched. This positions Argentina as the fourth most important Fintech market in Latin America, surpassing Chile, which currently has 75 Fintech startups, and shortening distances with the third largest Fintech market in the region, Colombia, which currently has 124 startups, and behind Brazil (230 startups) and Mexico (238 startups).

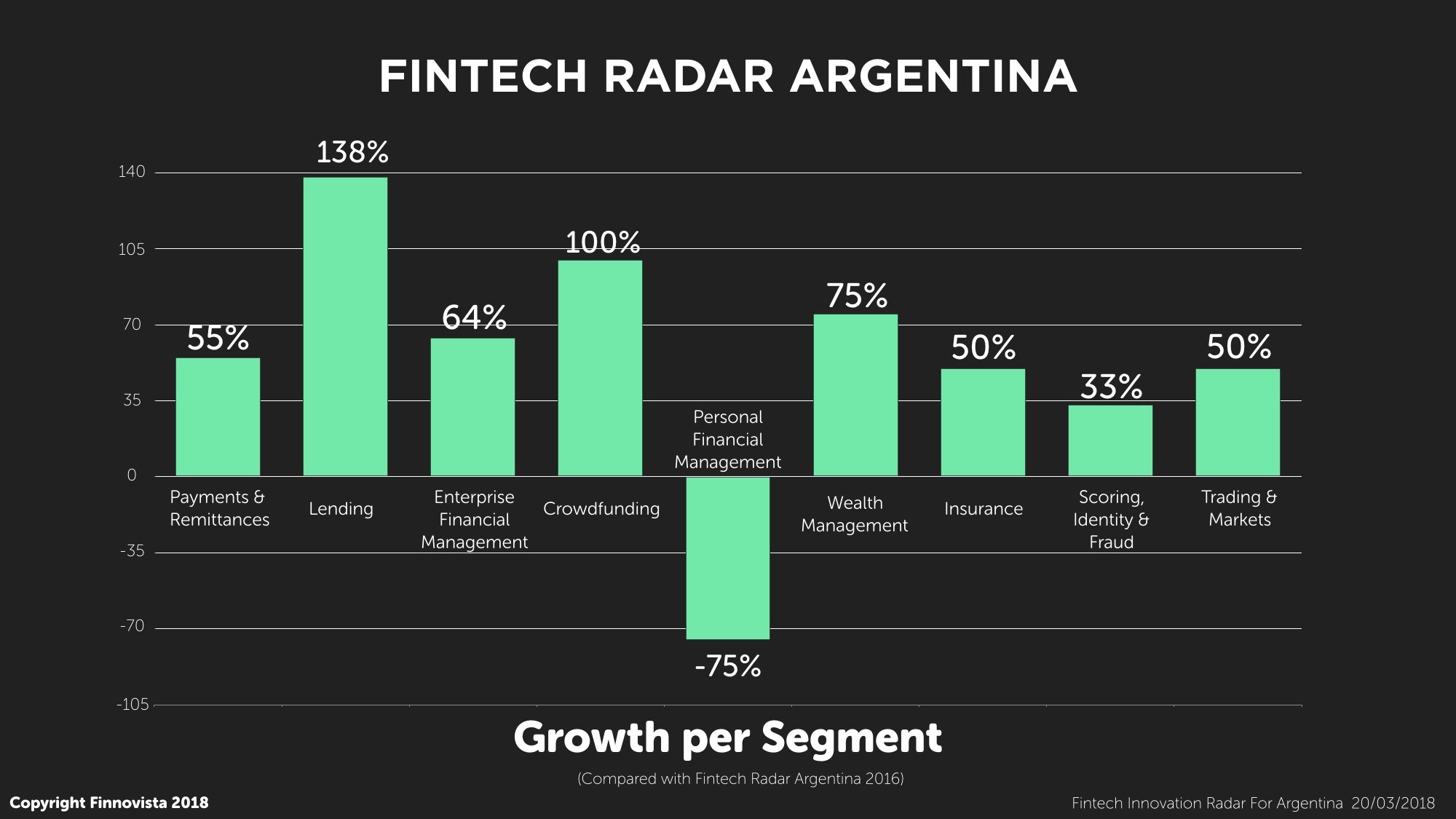

If we compare this update with the previous edition of the Fintech Radar Argentina, the results obtained from the analysis show interesting aspects to be highlighted regarding the ecosystem’s growth and distribution along the different segments.

However, it is important to point out that all the Fintech segments in Argentina, except the Personal Financial Management segment, have experienced considerable growths, as none of them have grown under 30%. Hence we observe that the Fintech sector in the country is growing in a diversified way throughout all the segments and there is a stable competitive landscape among all of them:

- Wealth Management, growing by 75% from 4 to 7 startups

- Enterprise Financial Management, which increased 64% from 11 to 18 startups

- Payments and Remittances, growing by 55% from 20 to 31 startups

- Insurance, which increased 50% from 4 to 6 startups

- Trading & Markets, which also grew by 50% from 2 to 3 startups

- Scoring, Identity & Fraud, increasing 33% from 3 to 4 startups.

The Payments segment, although it is still the largest segment in number of Fintech startups in Argentina (31) and has grown by 50% in the past 18 months, has lost relevance in terms of the proportion it represents of Argentina’s Fintech market, as in 2016 the Payments segment accounted for 33% of the total number of Fintech startups, and in 2018 it drops down to 28%. However, if we compare it with the main Fintech markets in the region, we can see that the Payments & Remittances segment in Argentina is growing at higher rates than in markets like Chile (annual growth of 35%) or Mexico (annual growth of 18%), but still way below the growth seen in Colombia (118%).

Meanwhile, the Lending segment, which in 2016 occupied the third position behind the Enterprise Financial Management segment, gains strength and positions itself as the second largest Fintech market in Argentina, with an impressive growth of 138%. It is not the first time we witness the importance this segment is acquiring, as in the last update of the Fintech Radar Mexico we observed how this segment grew by 60%, positioning itself as the largest segment beyond Payments & Remittances. In Argentina the Fintech sector has seized the opportunity of this market by offering new financing channels to a part of the population that previously could not access traditional loan sources. According to the Global Findex Data by the World Bank, only 22.7% of the Argentine population has access to bank loans, while in the private sector the relationship loans-GPD of the country is only of 14%, far below the 60% present in countries like Brazil and Bolivia or the average of 110% in Chile.

The Fintech ecosystem in Argentina is clearly awash with opportunities and ambitions to position itself among the main Fintech markets in Latin America. Besides its growth rates, it is also important to highlight the quality of the startups in this country, as in the last years we have witnessed success stories such as the startup Afluenta, the first P2P finance network in Latin America that has provided over $500.000.000 in 12 thousand financed loans and that in June 2017 announced an investment from the venture capital fund IGNIA, joining prior investments made by Elevar Equity and the International Financial Corporation (IFC); or Increase, the winning startup of the program Visa’s Everywhere Initiative 2017 and named one of the 30 Argentinian promises by Forbes.

Given this scenario, it is essential to have the necessary mechanisms that support the evolution of existing talent in Argentina. On one hand it is crucial that the collaboration between startups and large corporations evolves sustainably in a way that small startups can benefit from the greater assets of large corporations and their capacity to scale, at the same time they contribute to these large companies with their capacity to pivot, innovate and leverage new technologies to develop pioneering products and services in the industry.

On the other hand, the existence of key players that work to develop and strengthen the Fintech ecosystem from the inside is also key, by fostering initiatives that backup startups and work to create an adequate framework, adapted to the innovations that are yet to come. In Argentina the creation of initiatives such as the Cámara Fintech of Argentina is fundamental. This Chamber was launched in 2017 as the first organization of this type in the country and aims to transform and expand innovative financial services, improving inclusion and financial education in Argentina.

Finally, as we have already mentioned in the past, in order to have an ecosystem that permits a complete functioning and evolution of the Fintech sector, it is necessary to have new regulatory frameworks that reduce the operational risks of these new entrepreneurial projects at the same time they improve transparency and security within the sector. However, it is vital that these new regulations come at the right time and in the appropriate way in order to adapt to the particular characteristics of the sector, as it is necessary to avoid a hyper regulation that creates excessively demanding entry barriers that end up blocking further innovation. It will be interesting to see how more countries in Latin America decide to join the efforts of Fintech ecosystems like Mexico in approving the first Fintech Law in the region, approved on March 1st 2018, and how each country decides to catch this wave of financial innovation to confront future challenges and leverage opportunities that the technology offers to transform finance for the better.

Do you know about other Fintech startups from Argentina that have not been included in our Fintech Radar?