After publishing the Fintech Radars of Brazil, Argentina, Colombia, Mexico, Chile and Spain, we have created the Fintech Radar Ecuador, in which we have identified the current state of the Fintech sector in this country, which has grown substantially over the last year, giving rise to a bubbling Fintech and entrepreneurial ecosystem. Among other startups, we can find innovative projects such as the payments platform Kushki Pagos; or the first neobank in Ecuador, Credipy.

Following the wave of financial innovation present in other countries of the Latin American region, Ecuador has undergone a digital transformation in the financial sector, enabling the development of a high number of Fintech companies that offer alternative solutions to the population beyond the ones offered by traditional financial entities. In this way, the Fintech Radar Ecuador has identified 31 Fintech startups in the country, all of them technological projects with a high innovative component that helps the country enter the disruption league of the digital financial services.

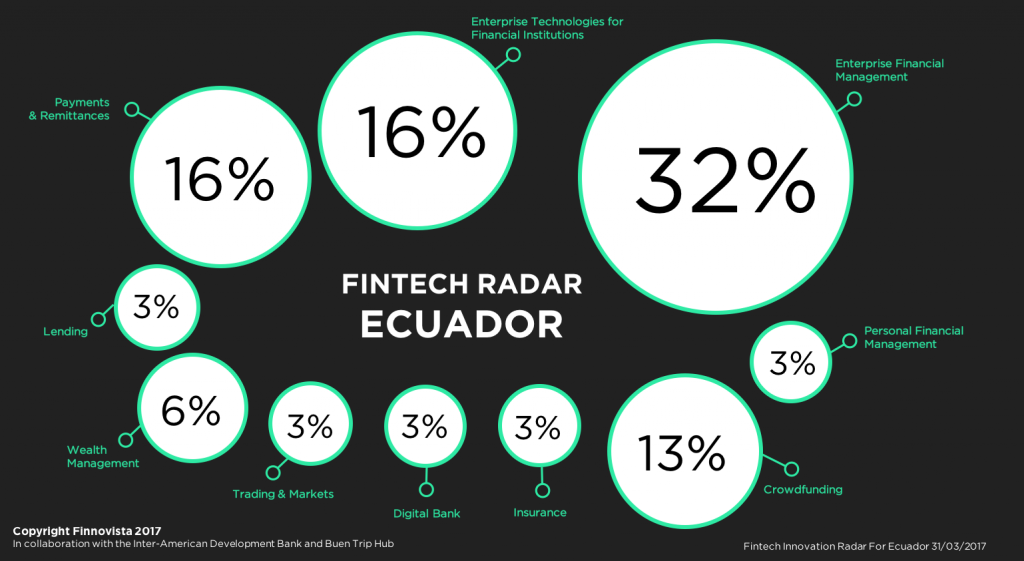

The majority of Fintech startups found in Ecuador is currently located in the Enterprise Financial Management segment, which covers 32% of the identified startups. In second place we find the segments denominated Enterprise Technologies for Financial Institutions together with Payments and Remittances, both accounting for 16% of the identified startups.

The Fintech Radar Ecuador reflects how this same situation takes place in a similar way within the Lending sector. In previous radars we have observed how this category tends to be the second most important in other markets of the region. For example, in Mexico 22% of the Fintech startups are focused on this segment, and in Colombia we find 17% of startups in this category. However, in Ecuador only 3% of the identified Fintech startups belong to this segment. If we consider that, according to World Bank data, in Ecuador the rate of adults with access to financial services lies around 46% and that only 13% has access to formal lending services, it is evident that there is an attractive business opportunity for Fintech startups within this segment.

Beyond the main segments, in Ecuador we also find startups operating within the segments of Crowdfunding (13%), as well as in Lending, Trading and Markets, Digital Banks or Neobanks, Insurance and Wealth Management, each of them representing 3% of the total number of startups and, thus, being emerging segments in the country.

So far the sector of financial services in Ecuador had lagged behind in comparison to other countries of the region; however, the growth in the number of Fintech startups identified in Finnovista’s Fintech Radar is a signal of how disruption and innovation are also bursting into this country. Nevertheless, in order to have a complete implementation and a long-term sustainable success of these Fintech projects, we will need to see an additional boost to the entrepreneurial ecosystem in the country, as well as collaboration with new players, such as Fintech startups, and an adaptation from a variety of actors to this new scenario, such as traditional banking entities and regulatory institutions, which will have to create a legal frame that adjusts to the emerging technological innovations.

From Finnovista, we want to thanks the collaborators Buen Trip Hub and the Inter-american Development Bankf or its important contribution to the creation of the Fintech Radar Ecuador, as well as Asobanca for its engagement throughout the process.

Do you know any other Fintech startup from Brazil that has not been included in our Fintech Radar?