In this update of the Fintech Radar, Mexico recovers the leading position with 394 Fintech startups slightly ahead of Brazil, the second largest ecosystem in the region with 380 startups according to the last edition of the report Fintech in Latin America 2018: growth and consolidation released in November 2018 by the Inter-American Development Bank (IDB) and Finnovista.

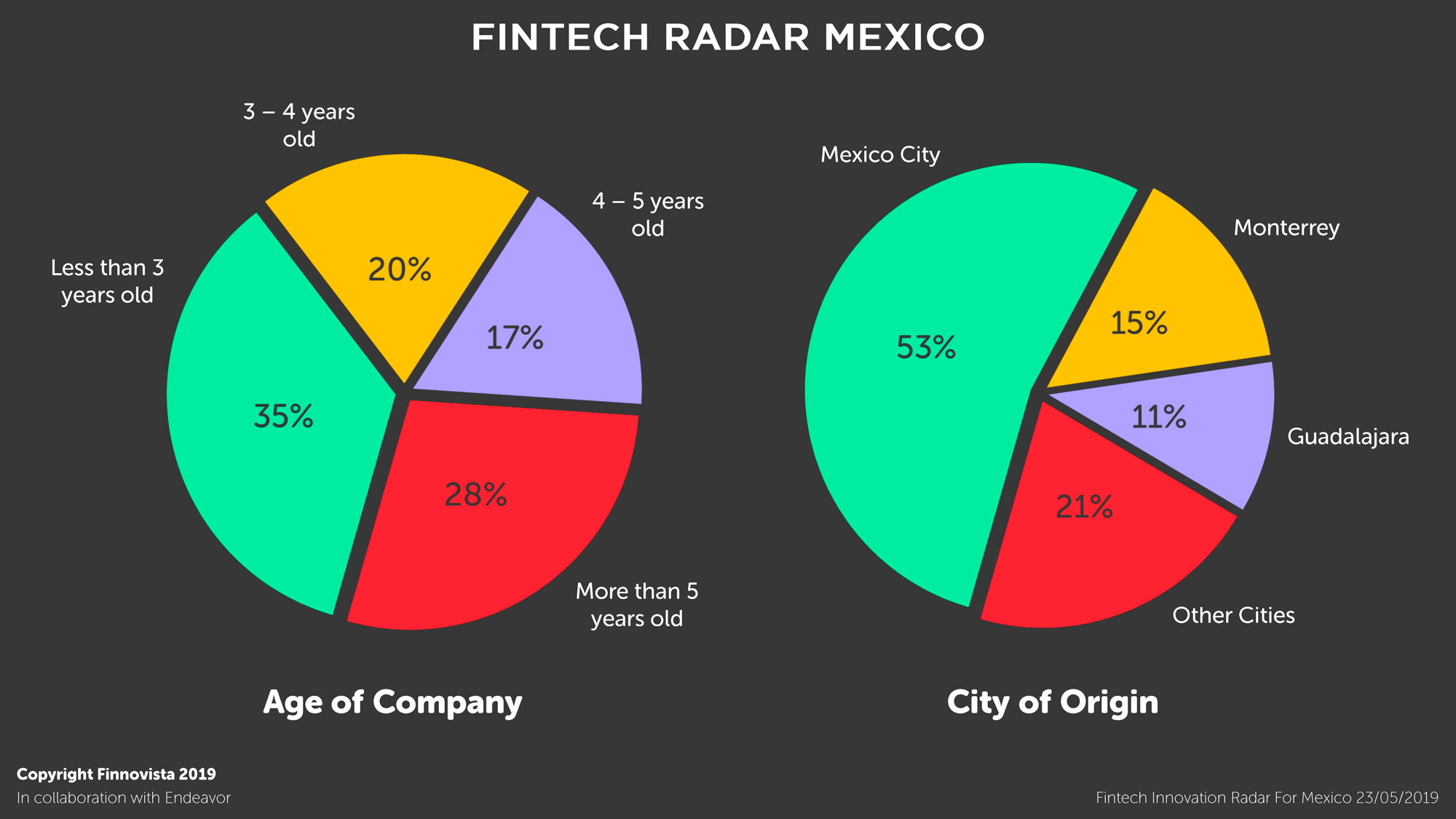

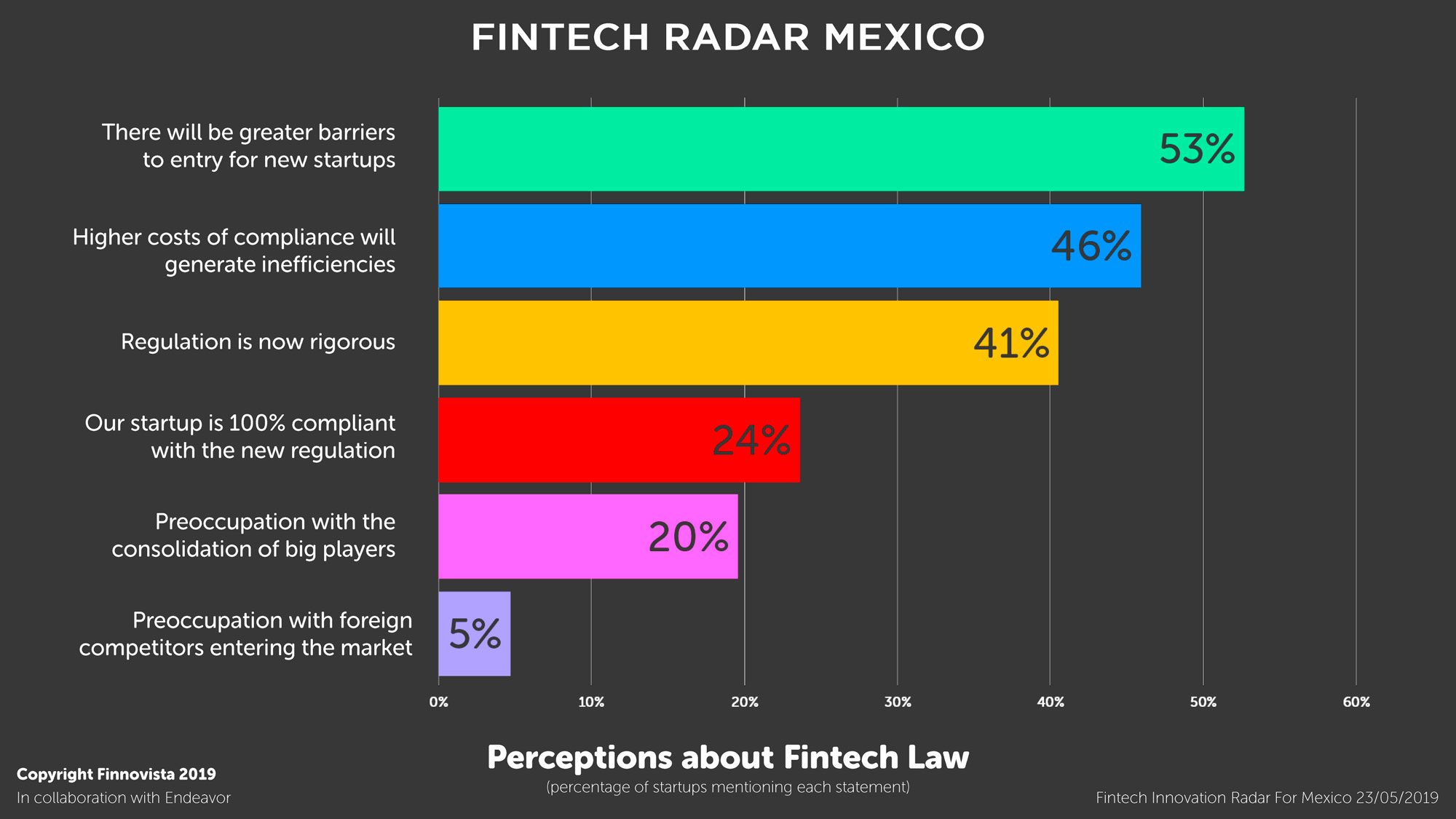

Financial technology companies in Mexico have witnessed an important evolution on their sector over the last few months, since the enactment of the Fintech Law on March the 9th 2018 and the publication of the secondary regulations on September the 10th. While the waiting generated some uncertainty, especially among companies focused on electronic payments and crowdfunding, the Mexican Fintech ecosystem recorded an 18% growth in the number of existing Fintech startups since our last radar published by the end of July 2018.

This increase is conditioned by two factors. On the one hand, we have identified 98 new startups born over the last months, which represents a gross growth of 29.3%. On the other hand, we estimate that Fintech mortality rate lies in 11.3%.

In collaboration with Endeavor Mexico and with the results of a survey responded by more than a third of the Mexican Fintech startups (148 startups), we present the fourth update of the Fintech Radar Mexico. In addition, we invite you to watch out for the publication of a complementary white paper that Endeavor Mexico will be publishing in June.

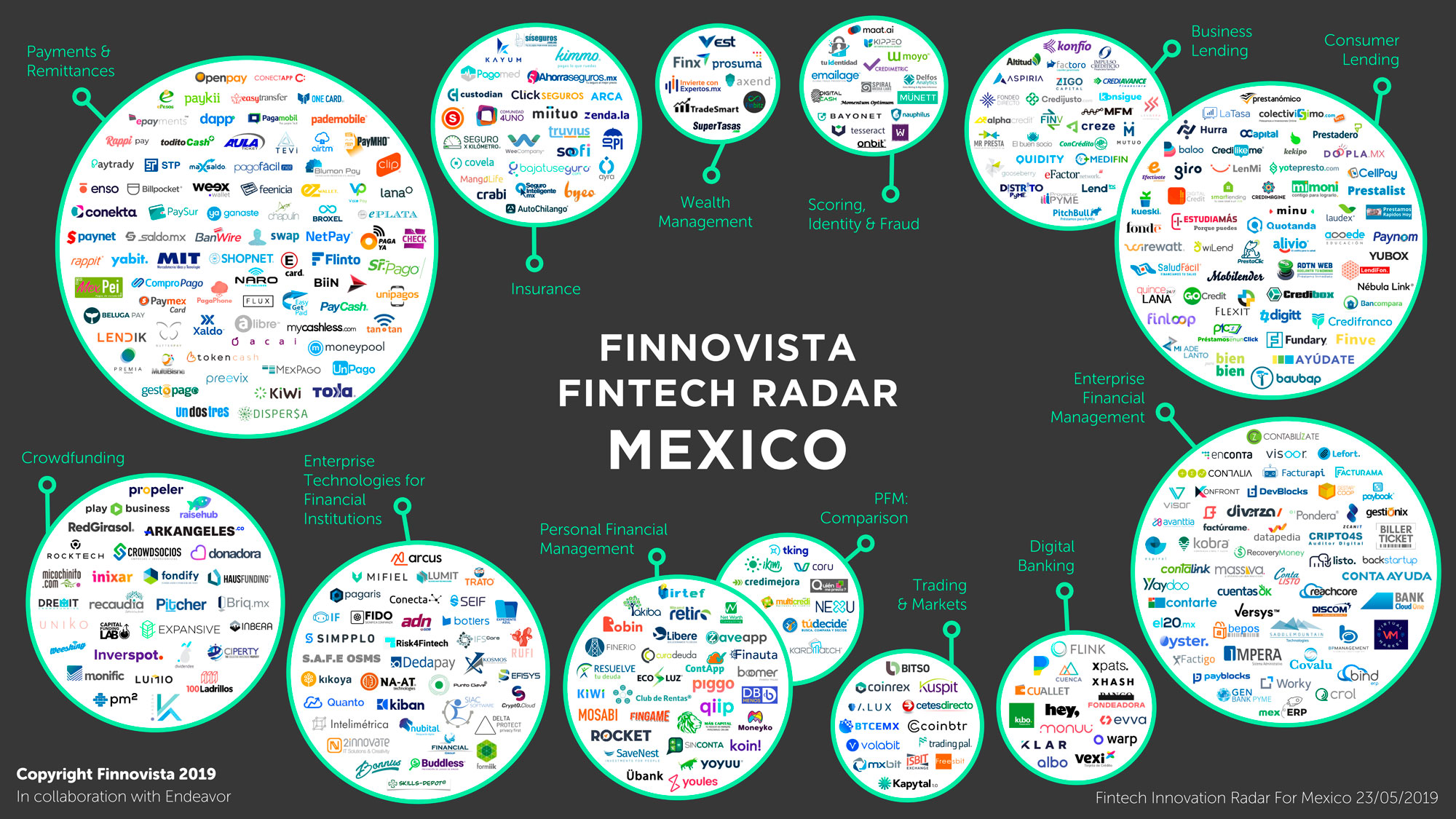

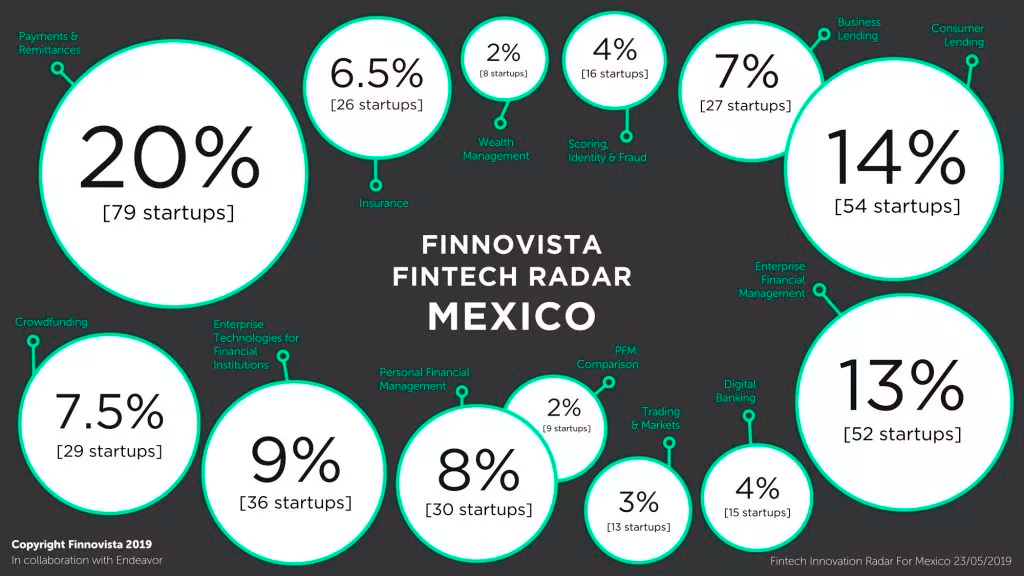

Currently the main segments in the market are as follows:

- Lending, accounting for 20.6% with 81 startups.

- Payments & Remittances accounting for 20.1% with 79 startups.

- Enterprise Financial Management, representing 13.2% of total with 52 startups.

- Personal Financial Management, with 9.9% of total with 39 startups.

- Enterprise Technologies for Financial Institutions, which accounts for 9.1% of total with 36 startups.

- Crowdfunding, with 29 startups, which represents 7.4% of total

- Insurance, which represents 6,6% of total with 26 startups.

- Alternative Scoring, Identity and Fraud, accounting for 4.1% with 16 startups.

- Digital Banks, representing 3.8% with 15 startups.

- Trading & Capital markets, with 13 startups, which represent 3.3% of total.

- Wealth Management, with 8 startups, 2% of total.

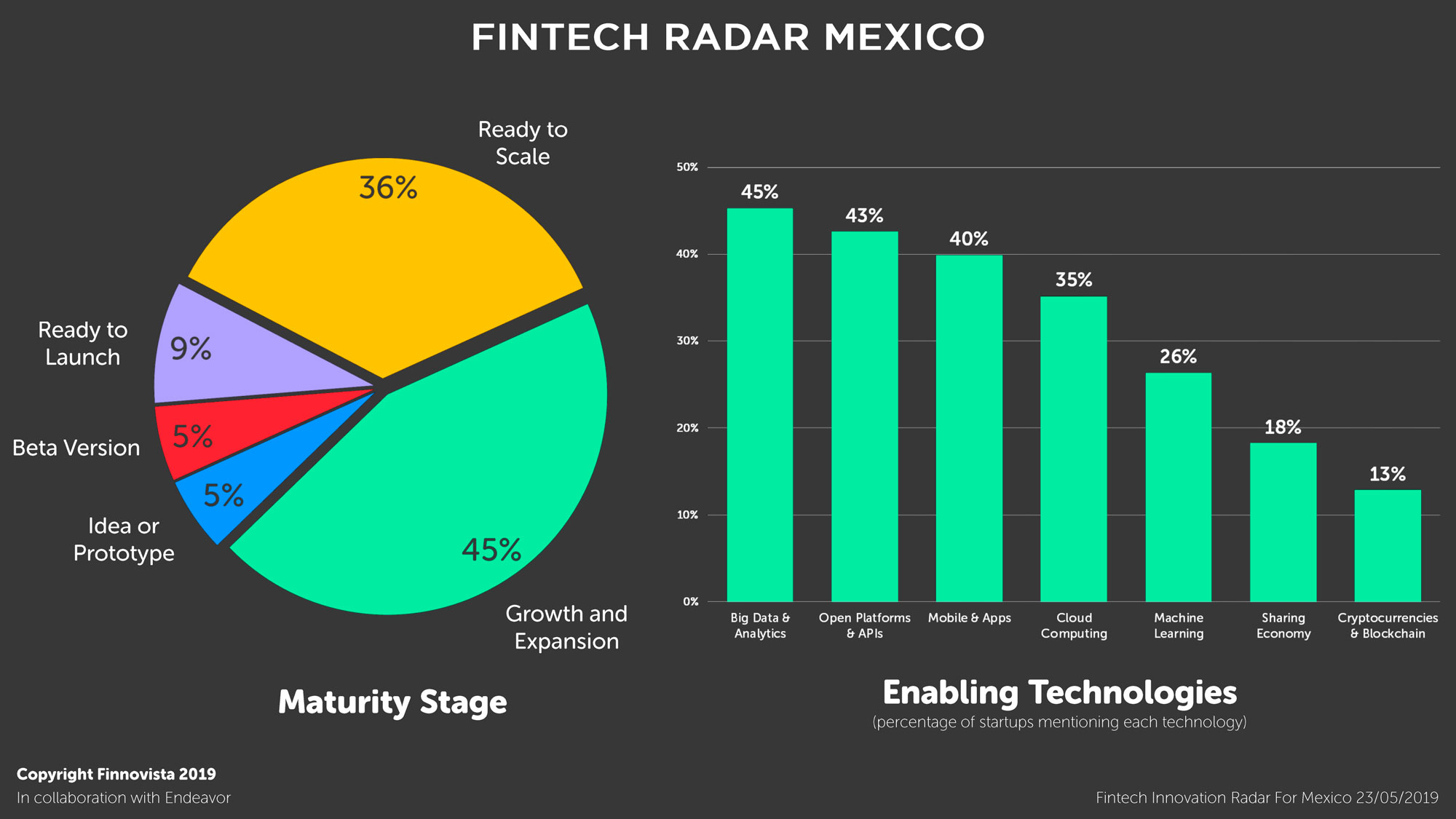

Regarding their maturity stage, 19% of surveyed Fintech startups claim to be in early stages ready for Commercial Launch, 36% recorded that they will be ready to Scale, while the remaining 45% is already in stages of Growth & Expansion. It’s worth noting that, in the last edition of this radar, the latter was 31%, proof of the maturity progression within the ecosystem.

In terms of technologies enabling these services and business models, we note a predominance of Big Data and Analytics, followed by Open Platforms and APIs, used by 43% and 45% of surveyed startups respectively. In addition, 40% of the companies claim to have a Mobile Application and mention using Machine Learning for the implementation of their value proposition.

Financial inclusion remains a main focus for Mexican Fintech startups. The data showed by the most recent national survey on Financial Inclusión, released in 2018, indicates that the financially included adult population (between the ages of 18 and 70 years) increased by 37% between 2012 and 2018, with 54 million adults utilizing at least one financial product in 2018 (68% of total adult population). Likewise, the number of adults with more than one financial product increased by 9.8 million form 2012 to 2018, which would mean that 45% of the adult population has more than one financial product.

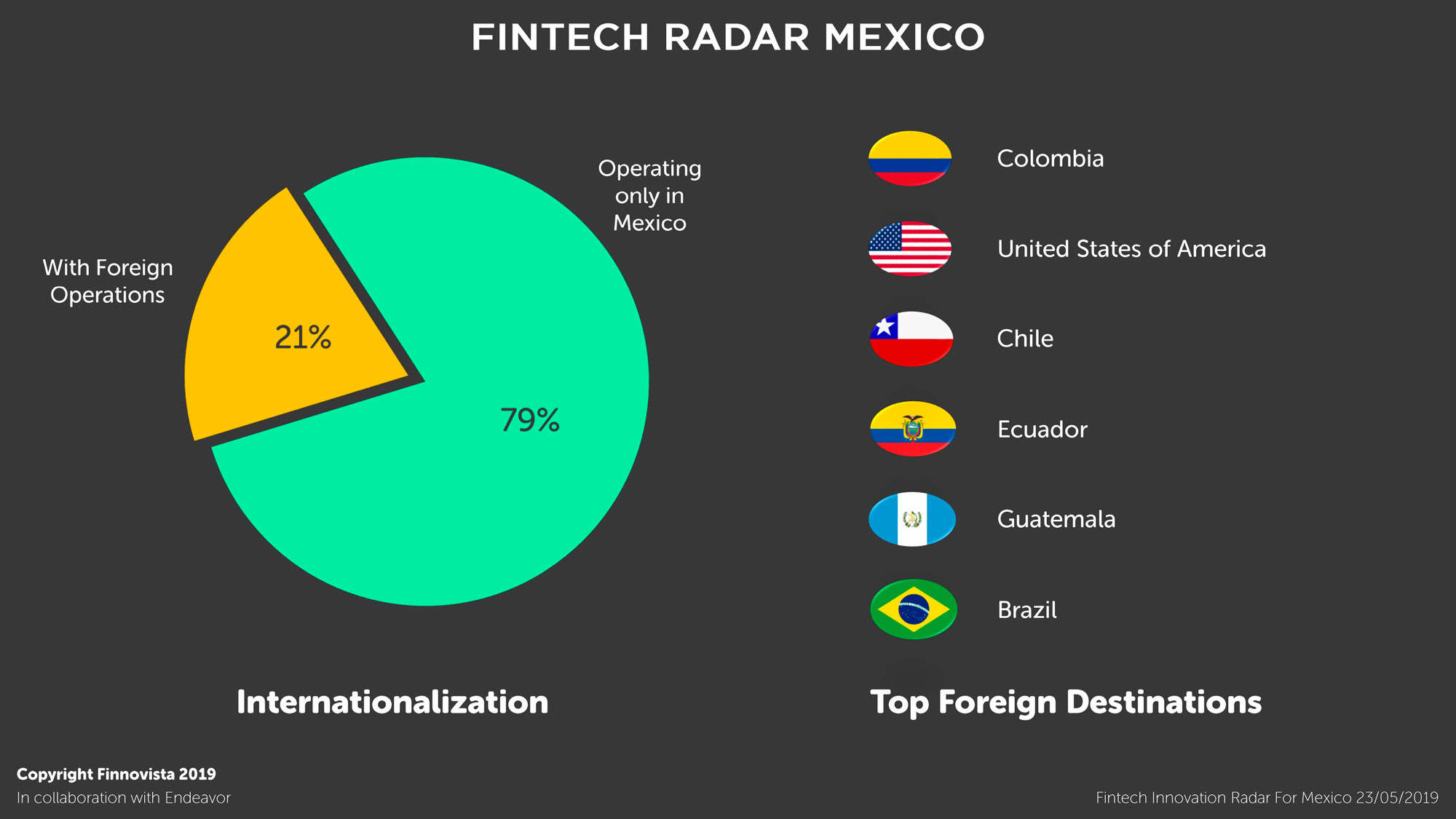

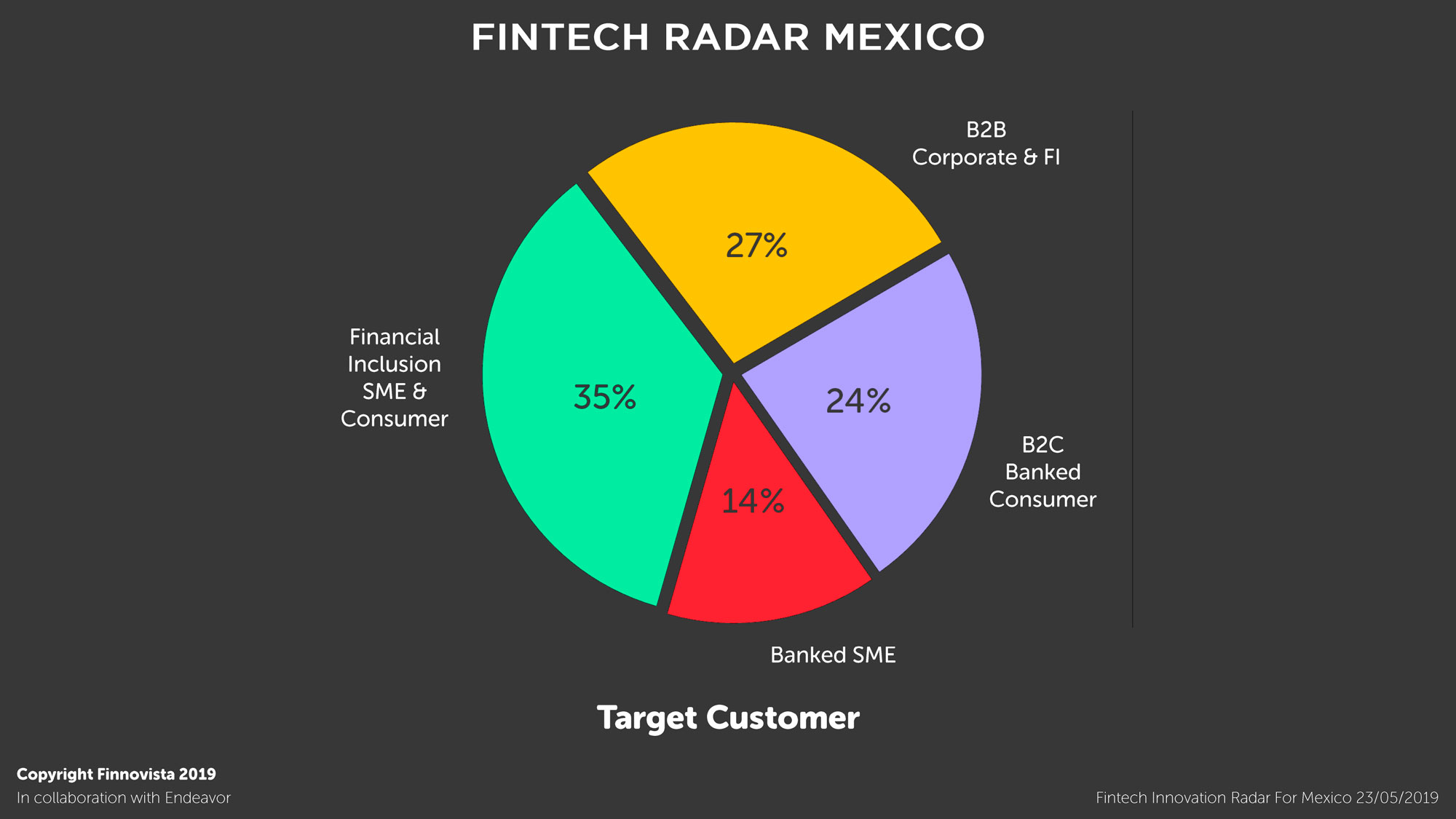

However, despite the progress over the past 6 years, 32% of the Mexican adult population still does not use any financial service or product and another 24% only has one. Thereby, financial services’ inclusion and democratization is still a significant opportunity, which is seized by 35% of surveyed startups that point out that their main target customer are unbanked or underbanked consumers or SMEs. A similar percentage, 38%, is focused on banked consumers or SMEs, whilst the remaining 27% aims at corporates or financial entities.

Do you know any other Fintech startup from Mexico that has not been included in our Fintech Radar?