– How did NovoPayment come about and what services do you offer today?

NovoPayment started as a project within a bank and was spun off once we realized the potential of what we’d created and that we had effectively become a technology company, or what today you’d call a Fintech.

NovoPayment started as a project within a bank and was spun off once we realized the potential of what we’d created and that we had effectively become a technology company, or what today you’d call a Fintech.

Our focus is simply to take financial processes that are complicated and expensive and make them simpler and more convenient for the customer and the banker.

Today, we offer three types of services: advisory, platform as a service and program management, all with an eye towards enabling digital financial and transactional services.

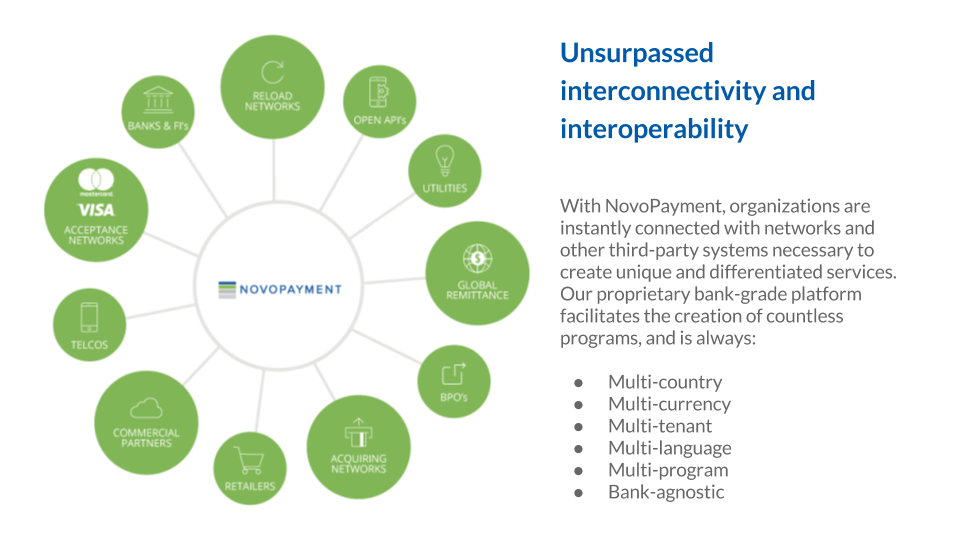

Our cloud-based, bank-grade platform and suite of APIs allow banks and others to talk to one another in a more robust, agile and orchestrated way and are designed to generate new deposits and transaction streams via varied mass disbursement and collections services. We deliver our technologies via White Label, modular APIs, and custom solutions.

– NovoPayment has worked very closely with financial institutions and large corporations from a variety of sectors. How has collaboration with these organizations evolved since you launched NovoPayment?

Collaboration today is more function-focused in the sense that each group and subgroup within these organizations is more specialized and has very different interests and concerns to be addressed. For example with banks and FIs, leadership is focused on business questions, such as the impact on deposits, interest and service revenue. Corporate customers are mainly concerned with the customer experience or “delivering in a better way”, and of course, the conversations with compliance and technology teams from all sides are centered on regulation, transparency, security, reliability, all of which are critical to success.

A key lesson we’ve learned here is to listen and focus the collaboration on what’s important to them. Everyone knows that this is a complicated business. There’s no need to remind them.

– Open collaboration and innovation seem to be the way to go in the financial services industry, and NovoPayment has recently joined this trend by launching its Developer Hub, the first open API portal of its kind for software developers in Latam. What is the objective of this project and how can it benefit Fintech startups?

The objective is threefold. First, to more easily enable banks, financial institutions, Fintechs and their customers to deliver enhanced customer experiences by lowering barriers to test concepts and deploy them on solid foundations. Second, to accelerate the expansion and diversity of the ecosystems that we and others can be a part of, and lastly to accelerate time to revenue for all parties.

– Latin America is one of the regions with the highest rates of financial exclusion in the world. According to the Inter-American Development Bank, approximately half of the Latin American population does not have access to any type of bank account. How can Fintech startups, and NovoPayment, in particular, help improve financial inclusion?

We think the answer is more openness and integration like we’re doing through our Developer Hub. We have not figured out the recipe for financial inclusion, but we know we need a pot. A pot with clear shape and edges that only regulators can define, and ecosystems open and diverse enough inside to motivate the individual and other relevant parties to participate.

– NovoPayment moved its headquarters to Miami a few years ago, a city that is becoming very attractive for entrepreneurs. What opportunities can Fintech startups from Latin America find in Miami?

In Miami, I think Fintech startups find a diverse business community in terms of the number of organizations and individuals with relevant regional and local experience and interests, be they from the technology, banking, payments or other skilled support areas. You also have a growing investor community, the major payment networks are here as well as many banks and multinational companies. I think Miami can also be a very practical and productive place to operate from the point of view travel and ease of doing business.

About Anabel Perez | CEO and co-founder NovoPayment

Anabel is CEO and Co-Founder of NovoPayment, a leading Fintech company that enables financial services and digital payments innovation throughout the Americas through a cloud-based, open platform that supports varied mass disbursement, collection, and mobile transactions. NovoPayment helps banks, financial institutions, e-money issuers as well as the travel and transportation industry, and others to leverage their existing legacy systems and services to generate new transaction streams and capture new deposits while reducing operational risk and accelerating time to market. Mrs. Pérez has more than 25 years of experience in banking and payments including commercial and retail banking, product development and financial services. Prior to NovoPayment, she served as Senior Vice President of Venezolano de Crédito, a leading Venezuelan financial institution, where she held several key positions. Under Mrs. Perez’ leadership, NovoPayment and its subsidiaries have garnered several important awards and recognitions including seven Paybefore Awards (2008-2017) and Latin Trade Magazine’s 10 Companies Under 10 Years (2010). Mrs. Pérez has been honored with several professional awards and recognitions including Endeavor Entrepreneur (2014) and the 2011 Paybefore Industry Achievement Award, the prepaid industry’s highest individual honor in recognition of her contributions to space and to financial inclusion in Latin America.