A 400% growth rate was observed in the creation of new Fintech startups since 2017, positioning Costa Rica as the country with the highest entrepreneurial potential in Central America.

The study published by the Inter American Development Bank (IDB) in collaboration with Finnovista, aims to illustrate the state of Fintech in Costa Rica, and ultimately create awareness about the main challenges faced by Costa Rican entrepreneurs. Among the most important issues to resolve is the lack of a central agency able to coordinate entrepreneurship-related efforts, as well as a lack of understanding of early stage specific needs by Angel Investors and other financing sources.

The study also addresses the milestones achieved towards building a robust entrepreneurship ecosystem, such as:

- 55% of key players within the Costa Rican ecosystem, offer entrepreneurs some type of financing.

- Startup mortality rate is 0% and the creation of new ventures increased 400% since the previous study published in 2017.

- Costa Rica has developed qualified human capital, thanks to foreign technology companies with operations in the country.

- Costa Rica’s mobile penetration rate is among the highest in Latin America.

- Given its manageable size, the Costa Rican market is ideal for proof of concepts and pilot programs.

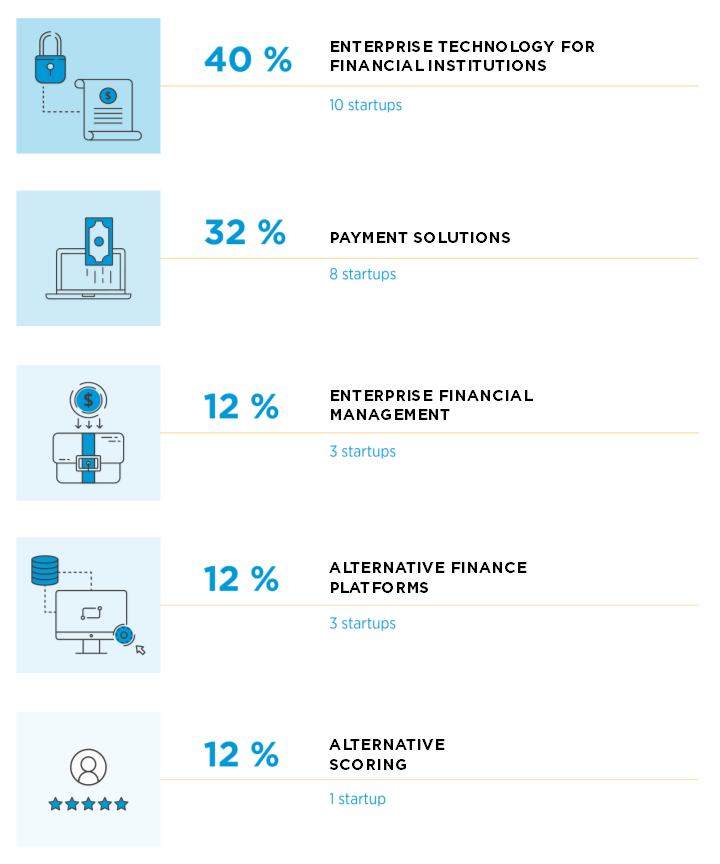

There are 5 clear Fintech segments in which Costa Rican startups are innovating:

-

- Technology Solutions for Financial Institutions.

- Payment solutions for consumers.

- Financial governance solutions for businesses.

- Crowdfunding and Alternative Financing platforms.

- Credit Scoring solutions.

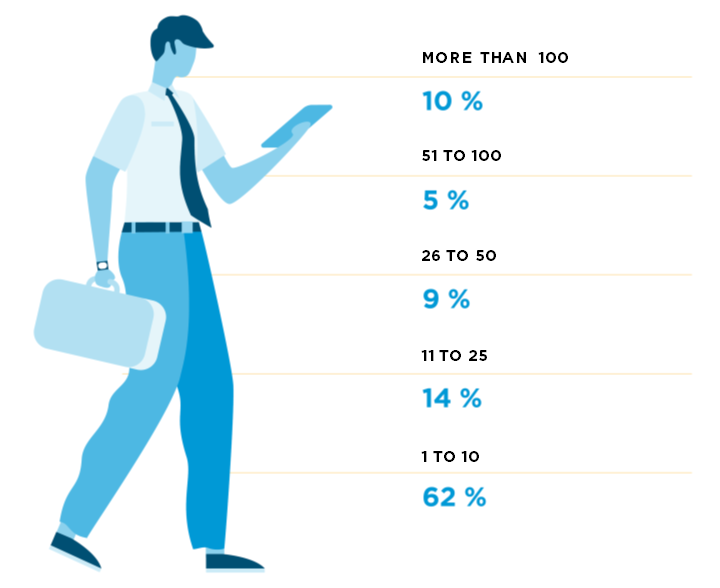

Other interesting insights included in the study, is the analysis of the different stages of development of Costa Rican startups, as well as their size in terms of number of employees. This gives us an idea of how important it is to focus on actionable strategies towards early stage startup projects.

You’ll also find an analysis of the regulatory landscape in Costa Rica, as well as a benchmark framework that includes regulatory mechanisms developed in other important Fintech hubs such as the UK and Mexico.

A positive sign is the presence of Costa Rica as a member country of the Fintech Association of Central America and the Caribbean, in which 4 commissions were created to establish regulatory clarity in the Costa Rican Fintech Ecosystem:

-

- Education Committee

- Research and Technology Committee

- Regulation Committee

- Network Creation Committee

According to Mario Hernandez, Impesa’s CEO, “Costa Rica’s regulatory framework should protect users enough so that the market continues to be a fertile ground for disruptive models to grow, but these mechanisms should be creative and practical enough for Fintechs to be able to actually innovate”.

Under this premise, the Inter American Development Bank and Finnovista included an analysis of regulatory mechanisms in other latitudes such as Project Innovate in the UK and Fintech Law in Mexico, so as to suggest the usage of international know how in the design of Costa Rican policy, which will ultimately create a safe space for Fintech entrepreneurs to innovate within a legal framework of financial services.

Through almost 100 pages of relevant information and data for authorities and key players in the financial and technological industries, the Inter American Development Bank and Finnovista aim to contribute to the discussion of Fintech and Financial Inclusion in Costa Rica and the rest of Latin America. We encourage you to download and read our complete publication in Spanish through the following button.

About the IDB

The Inter-American Development Bank aims to improve lives. Founded in 1959, the IDB is one the main long-term funding sources for economic, social and institutional development in Latin America and the Caribbean. The IDB also carries on cutting-edge investigation projects and offers counseling on politics, technical assistance, and training to public and private clients across the region.