Startup Programs

At FINNOSUMMIT we believe in the transformative impact that comes from collaboration between the ecosystem, financial institutions, tech companies, investors, and Fintech startup entrepreneurs. Our mission is to drive financial innovation to build a stronger and more dynamic financial future in Latin America. We partner with the architects of financial technology transformation: Fintech entrepreneurs, who bring new perspectives and disruptive solutions to challenge the industry's status quo. We also connect them with players in the ecosystem, such as corporations and investors who seek to enhance their growth and impact through collaboration with Fintech startups.

The potential to participate in programs supported by key players in the financial industry

Our mission transcends mere innovation; we strive for transformative change that profoundly impacts the financial industry and, by extension, the businesses and society of Latin America.

In our programs and startup competitions, we cultivate collaboration and fortify the ecosystem, ensuring that finance in the region epitomizes innovation, inclusion, and growth.

Benefits for Fintech entrepreneurs applying to our startup programs

Access to the largest Fintech network in Latin America: Participating in our programs expands the network of contacts, facilitating collaborations with other startups, corporations in the financial and technology industry, as well as helping to gain potential customers. These connections are of great value for entrepreneurs looking to form strategic alliances or find new markets.

Possibility of strategic collaborations: Participating in internationally renowned innovation competitions managed by FINNOSUMMIT (such as Visa Everywhere Initiative or BBVA Open Talent) provides Fintech entrepreneurs with a global platform to highlight their project and connect with leading corporations in the financial industry. Startups have the opportunity to create connections with other ventures in the region through exclusive events and networking activities with investors and corporations during the program.

Access to funding and specialized mentoring: Participation in engagement programs provides early-stage Fintech entrepreneurs with direct access to investors and key players in the ecosystem and the financial industry that help take startups to the next level. FINNOSUMMIT offers access to a network of more than 400 experts in the Fintech ecosystem that helps entrepreneurs develop scalable business models, talent attraction and management, and access to funding, among other resources.

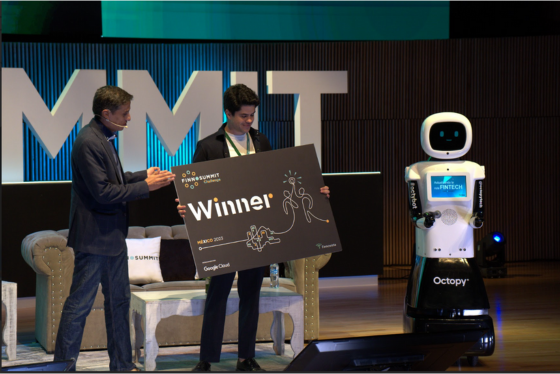

Market exposure and visibility: Participation in these initiatives brings with it associated media and marketing exposure opportunities, which can be vital for early-stage startups to gain market exposure and attract new customers and investors. FINNOSUMMIT Challenge gives entrepreneurs the opportunity to boost their projects, compete for prizes and resources that will drive their business development; but also to present their innovative solutions to the influential FINNOSUMMIT community at the premier Fintech gathering in Latin America, with extensive media coverage.

Positioning in the ecosystem: We organize other initiatives that give entrepreneurs the opportunity to make their ventures known and grow hand in hand with large corporate leaders in the sector. Constant interaction with corporations provides valuable feedback, and this continuous learning is essential to adapt quickly in an industry as dynamic as the financial one.

Joining FINNOSUMMIT's Fintech startup programs is not only a step towards success, but also an invitation to be part of a vibrant community that drives innovation and collaboration in the financial world in Latin America. At FINNOSUMMIT we walk side by side with entrepreneurs to empower their entrepreneurial journey towards achieving bold business goals that will result in revolutionizing finance in the region, while accompanying corporates on their journey of collaborative innovation with startups.

Success Stories of Our Sponsors

Our entrepreneurs

If you want to boost the growth of your startups and create strategic partnerships with key players in the Fintech ecosystem, don't miss our calls for startups.